Oyster liquidation update

First reported by Yachting Monthly, the announcement of Oyster Yachts going into liquidation sparked confusion with many questioning whether or not it was ‘fake news’. However the story has now been confirmed.

This afternoon, CEO of Oyster Yachts, David Tydeman, released the following statement on their website: “It is with sincere regret that we advise that the Company has been unable to secure financial support to enable it to continue at this time and it is looking at all opportunities available. Further information will be issued as soon as we can.”

A letter, signed by Ben Collett on behalf of Oyster Marine Limited, was sent out on Monday to members of staff saying that the company “has been unable to secure financial support to enable it to continue to trade at this time and it is now facing entering into an insolvency procedure imminently. After considering all possible options, the company has concluded that there is a risk that it will be unable to continue to provide work for all its employees at all locations and that it is likely that it will have to make all of its employees redundant. The company has run out of cash and is unable to pay employees for work. The company has decided to close all operations today (and for the immediate future) to prevent or minimise all loss to employees and all other creditors.”

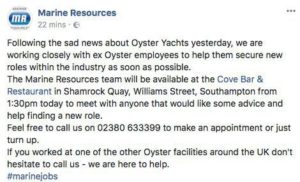

The BBC are reporting that a total of 400 jobs are in danger. Marine Resources have stated that they are “working closely with ex Oyster employees to help them secure new roles within the industry as soon as possible.”

The Oyster Group is made up of Oyster Marine Ltd, Oyster Brokerage Ltd and Southampton Yacht Services Ltd and has offices in Ipswich, Wroxam in Norfolk, Mallorca and Newport Rhode Island. Over 300 redundancies are currently being made in Southampton and Norfolk. Workers were sent home earlier today from the boatbuilding yard in Norfolk after being told their employer “has run out of cash”.

The news has come as such a huge surprise largely because Oyster Yachts had recently announced that they finished 2017 with a record orders amounting to more than £80 million. See our article here- /oyster-closes-2017-record-order-book/

The company had also recently publicised the progress of some new moulds for their Oyster 825 and 895 models.

The main reason for the company’s sudden liquidation appears to be due to the heavily rumoured news that Dutch investment firm HTP Investments has withdrawn financial support for Oyster Yachts; They bought the company for just under £15 million in 2012.

Oyster Yachts was sold in 2008 by founder Richard Matthews to Balmoral Capital for roughly £70 million. The acquisition included the Oyster Group companies Oyster Marine Ltd, Oyster Brokerage Ltd and Southampton Yacht Services Ltd. Some industry sources suggest that Oyster’s financial trouble started when the company were dealing with structural defects identified following the failure of Oyster yacht Polina Star III, which sank off the coast of Spain in 2015 after losing her keel. The amount of money lost because of this has not been disclosed to the public.

What happens next?

There’s currently a lot of speculation about what Oyster may do next. Some believe that other investors may potentially ‘buy the brand’. Here’s what people have been saying on http://sailinganarchy.com

Soley said “Wouldn’t shock me if Richard Matthews steps in with a rescue package, rights the company and moves on again. Niklas Zennström style. I think Presuming Ed nailed it. The investment firm probably over leveraged the company and they couldn’t afford the nut. An £80m order book means nothing if it costs £81m to fulfill those orders and pay the bank….”

Svanen said “I agree about the brand’s strong reputation. I doubt it would be effectively transferable to an Asian builder … but that’s just my opinion. Part of the high brand value has been based upon the company’s excellent aftermarket support, even for third- or fourth-hand owners of quite old Oysters. I wonder how much this sad development will adversely affect resale value. Oyster has also been known for preserving excellent documentation for all of the individual boats: many were semi-custom built, and included various owner-specified equipment. I hope those archives will be preserved, but fear that they will end up in a tip.”

Paul Griffiths, ex Project manager at Oyster Yachts, added a level of optimism when he commented on Yachting Monthly’s article saying “Sad times, but I am sure that won’t be the end, the brand is far too valuable for that”

How sad that yet again an investment company destroys our industrial companies! £80m order book is possibly fine for paying all normal running costs, wages and directors but what they struggle to do is pay large enough dividends to shareholders who are just speculators. They have little concern for the brand, the employees or their lives.

the hard work that all the staff put in to the company over the years , just for shareholders who take the vast majority of profit , and to leave over 400 people for who that are own wages that have not been paid for there hard work over the last week and month is just gut wrenching ,